The complete, data-driven guide to music festival marketing

Drawing on a first-ever study of Tally's music festival ticket-purchasing data, this performance marketing guide uncovers new KPIs, analytical insights, and valuable cost-saving tactics for your festival marketing strategy.

For decades, the music-festival business was largely a mystery wrapped in an enigma. The biggest and best festivals seemed to thrive on pure word of mouth, while the rest struggled for survival. Today, the music festival market is mature and highly competitive, and standing out from the competition has become essential to attracting repeat fans.

Thanks to years of first-party data collection, we now know a great deal about how festival ticket sales actually work: How audiences learn about festivals, how they consider which tickets to buy and when, and what tactics drive them to ultimately complete their purchase. But most festival promoters—even the ones who are collecting and analyzing their own data—often don’t have the time or the expertise to dig deeply into their analytics. They may also lack benchmarks to which they can compare their own experiences.

TABLE OF CONTENTS

That’s why we’ve created our first-ever study of music festival ticket purchasing data. Our analysts examined—day-by-day and hour-by-hour—the millions of interactions that led hundreds of thousands of music fans to purchase millions of music festival tickets. In the aggregate, gathered across years of ticket marketing, this data helps us think about some of the most contentious topics in music festival promotion. In this guide, we’ll examine insights and data around questions such as:

- Is there a correlation between a strong on-sale and overall ticket sales?

- What are the most important metrics to optimize for, in order to drive maximum revenue?

- Does messaging around ticket-price increases actually help sell more tickets?

- How far in advance of a festival do promoters typically release tickets?

- How can you increase revenue from a festival that sells out every year?

Years ago, when we went looking for a platform that could help us answer these questions to predict music-festival ticket sales for our clients, we couldn’t find one. So we had to build one ourselves. The data in this report is drawn from TallyTickets.com, the platform for advanced festival data analytics we launched in 2023, which has tracked millions of ticket sales at dozens of festivals. Festival marketers using Tally have access to sales data in real-time, which allows quicker pivots during the most crucial ticket-sales windows, as well as better modeling of fan behavior. How accurate can your predictions get? In the past, we’ve gotten pretty close.

With over 15 years of experience working with America’s biggest music festivals—from Bonnaroo and Newport JazzFest to Governors Ball and Boston Calling—we’ve developed dozens of strategic plans for festival marketers. (Our work with Governors Ball recently became the subject of TikTok's first-ever live-event case study in the United States.) We’re also drawing on our experience driving ticket-sales campaigns across live events as diverse as superstar concert tours; games in the NFL, MLS, NBA, NHL, and WTA; arena performances from comedy to SuperMotocross to the X Games; and much more. In this guide, we’ll drill down into our music-festival data findings, and then cover 8 key strategies every festival marketer needs to master along their path to success.

Quick—before you read any further: Imagine you’re putting on a popular music festival. If you had to guess, what percentage of ticket-buyers for this year’s festival are returning from last year, or from any previous year?

The number is likely lower than you’d think. Using the Sales Overlap feature in Tally, we examined the data from music festivals for which we had at least 3 years of data — in some cases up to seven years. When we looked at the percentage of ticket buyers who purchased in more than one year, the highest overlap we found for any single festival was 27% — and that was, by far, a remote outlier. For all other festivals we examined, the percentage of repeat buyers ranged from 12% to 17%.Now, that’s almost certainly an under-count, because we’re looking at unique purchasers—so if last year you bought tickets for yourself and three friends, and this year your friend bought tickets for the same group, neither of you would show up as a repeat purchaser. But even allowing for that undercount, we believe festivals are off by an order of magnitude when they predict how loyal their fans will be from year to year.

Source: Gupta Media's TallyTickets.com data, 2025.

What’s the takeaway? This seems obvious, but it’s truer than you might think: With a handful of exceptions, ticket buyers’ decisions about music festival purchases are weighted heavily on the strength of this year’s lineup. Think of it this way: Every year, 80% of your audience has likely never attended your festival before. For example: If you’ve built a 50,000-person SMS list in 2025, don’t expect more than 5,000 purchasers from this cohort to purchase in 2026. So if you’re relying on your existing email and SMS database to drive on-sale lift, you’re already playing from behind.

While lineups sell tickets, that doesn’t mean you shouldn’t market the value of on-site experience — we still see success with ads that hype lifestyle, fan experience, food vendors, and other differentiators that prove the festival offers more than just another music concert. (See “Know Why Your Fans Want To Attend,” below.)

We get a lot of questions from music festival marketers about the pacing and velocity of ticket sales: When should you crank up the spend? When should you keep your powder dry? When are ticket buyers most likely to engage?

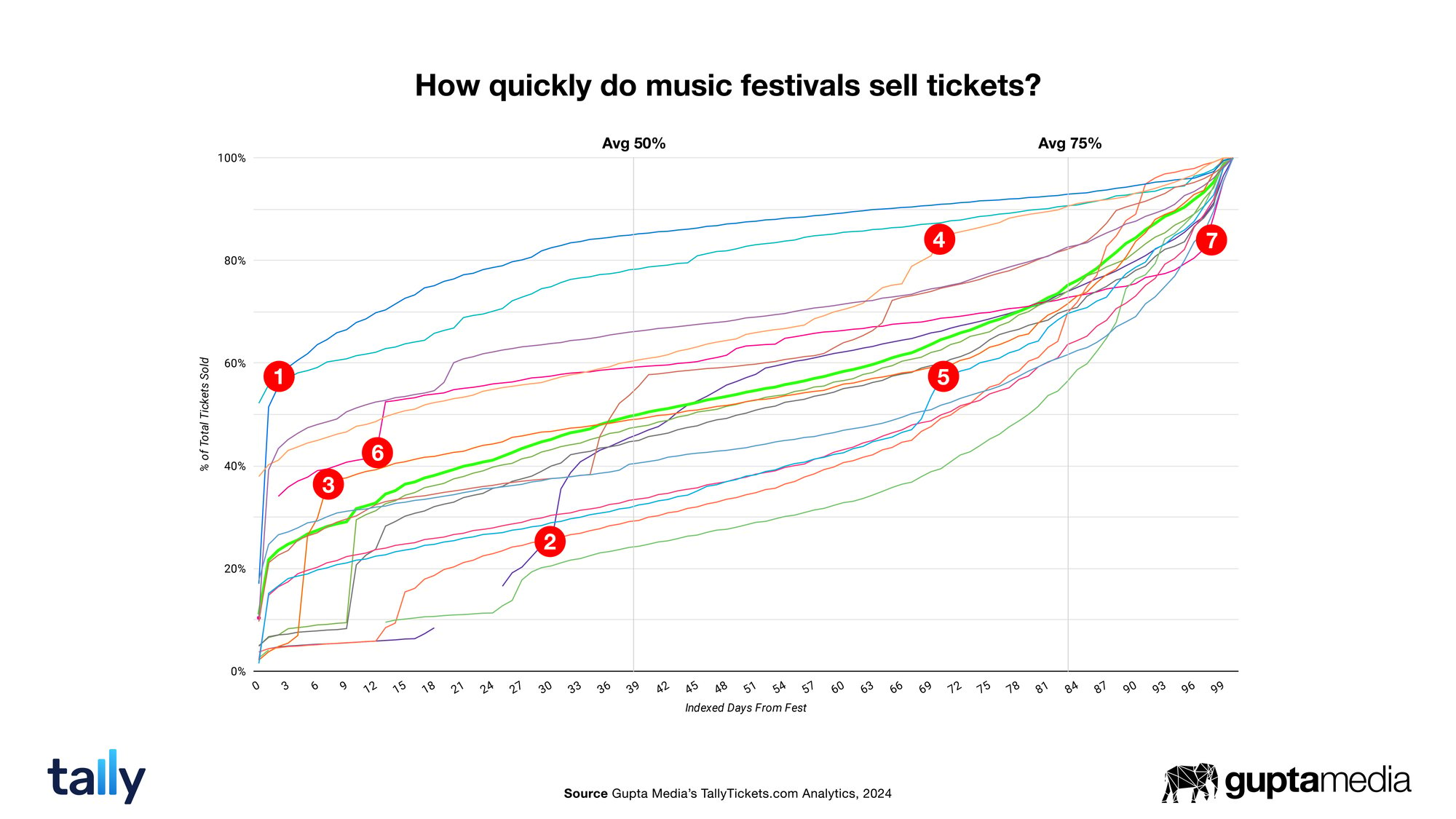

Let’s start by looking at the relationship between music festival on-sales and ticket sales during the rest of the cycle. In the graph below, each line represents a unique sales cycle for one festival during one year.Chart: An indexed view of music festival ticket sales over time. Each line represents a distinct year of a distinct music festival. Ticket sales refer to the percentage of actual total tickets sold by the festival, not percentage of festival capacity. Indexed days represent a percentage of each festival's total on-sale time. Source: Gupta Media's TallyTickets.com, 2025.

The average number of days in a festival sales cycle—that is, the time from on-sale to the first day of the festival—is 163 days, according to an analysis of Tally’s data. That’s an eternity. Most festival promoters focus heavily on the beginning and the end. In between? It’s often a no-man’s-land, filled with guesswork, inefficiency, anxiety, and shots in the dark. How can we start to take the ambiguity out of music festival sales? Let’s take a look at the data.

In the graph above, we’ve created an index to make comparisons between festivals of different sizes, different ticket capacities, and different sales cycles. Not all of these festivals officially sold out — so the “100%” at left represents, simply, the full amount of tickets actually sold in any given year, not 100% of all tickets available. Likewise, the bottom axis doesn’t represent the actual number of days but instead a percentage of the sales cycle. What this allows us to measure is a relative snapshot of where in the cycle a festival is seeing the majority of its sales activity. We’re also able to compare the many arcs that different festivals travel on their journey to the finish line.

Each line in the graph represents the ticket-sales trend for a single year of a single festival. The thicker, neon-green line running through the middle represents a benchmark average of all festivals. What we find is that, on average, it takes:

- 39% of a festival’s sales cycle to reach 50% of ticket sales

- 83% of a festival’s sales cycle to reach 75% of ticket sales

Of course, there are outliers in both directions. First, let’s look at (1) in the graphic above — the uppermost Dark Blue line and, just below it, the Light Blue line. These two festivals, in different cities in different years, had a similar on-sale strategy:

- The lineup was announced in advance of tickets going on-sale

- All ticket levels—multi-day tickets and single-day tickets—were released at the same time.

In both cases, more than half of all tickets eventually sold were purchased within the first 48 hours. Your mileage, of course, may vary: Both festivals had strong lineups with significant organic buzz. In other years, and at other festivals, similar tactics have produced less dramatic results.

Now let’s look at (2)— the Dark Purple line, where we see a big jump about 30% into the sales cycle. For this festival, the promoters used a presale to offer discounted festival tickets well in advance of announcing the lineup. The break in the line? After the initial offer, presales actually went dark—followed by another presale to capitalize on the holiday shopping rush. The big leap, then, corresponds with the festival announcing the full lineup and putting all ticket types on sale. And in yet another approach, the festival at (3) offered pre-sale tickets to past-purchasing festival “alumni” as a precursor to a full-fledged on-sale, which drove the takeoff spike in ticket sales.

The late-cycle jump in the Blue line seen at (5)? And the two-day jump we see at 12% of the sales cycle for the Hot Pink festival line (6)? Both show a spike generated by urgency messaging — in this case, about a coming increase in ticket prices. At the tail end of the Hot Pink festival’s cycle (7), we see the fastest acceleration in sales of any festival we measured, which was driven by a number of factors. Among them: A rare ticket-pricing discount in the run-up to the festival, as well as a VIP ticket-giveaway promotion. Likewise, the boost in sales seen at (4) is the result of a three-day discount on single-day tickets.

Is your music festival stuck in the middle?

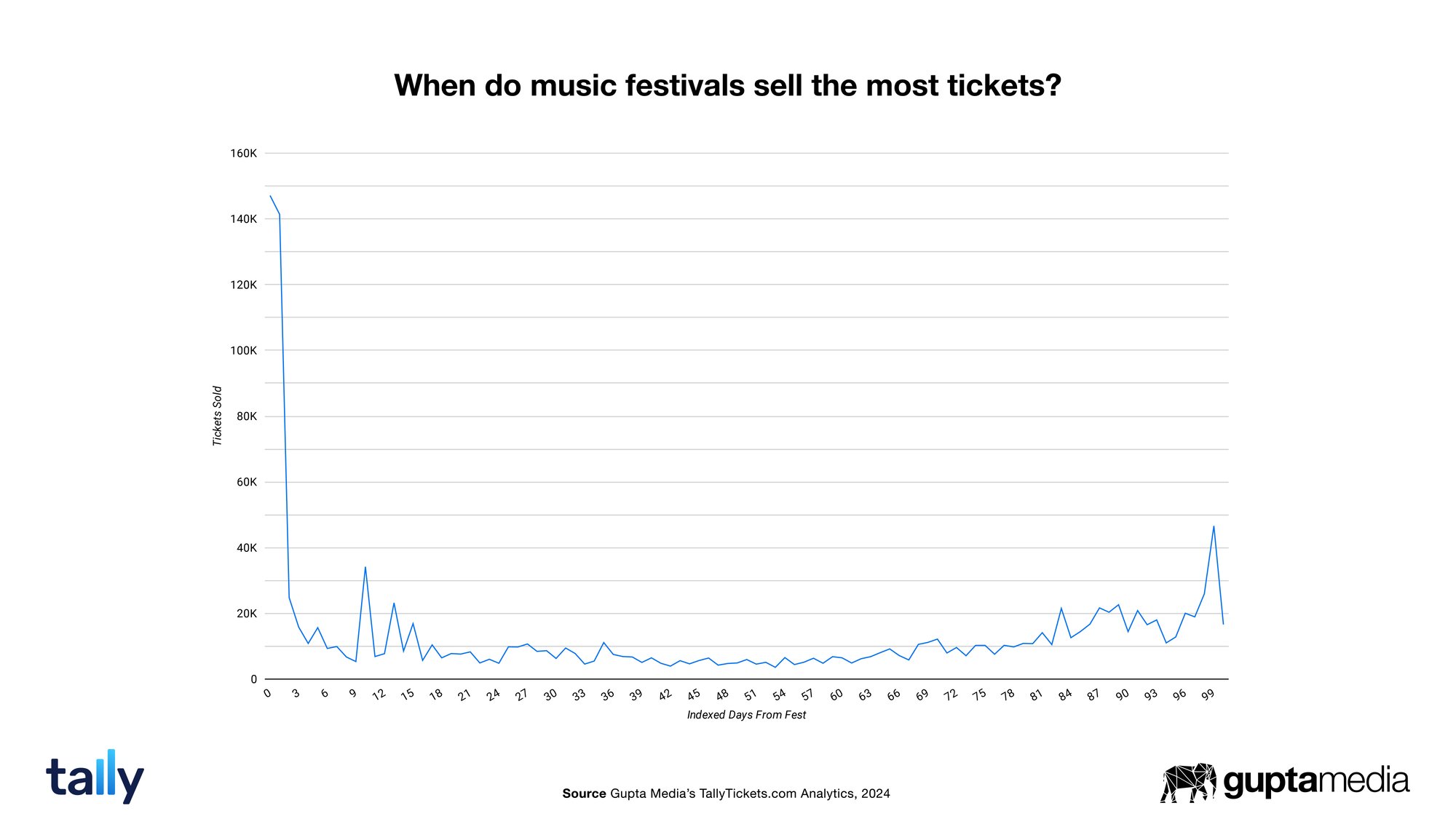

Festival promoters are aware that the graph of ticket sales over time is generally a U-shaped curve — a big jump at the beginning of the cycle around on-sales, followed by a steep decline with only occasional jumps in the middle, and then an accelerating rush to the finish. But what kind of U-shape? What are the contours of the decline and the ramp-up? The answer isn’t simple — festivals exhibit different patterns based in part on strength of lineup, or on factors such as whether they stagger their on-sales for multi-day tickets and single-day tickets. But we wanted to create a benchmarking tool for festivals, which would show an aggregate average of when ticket sales tend to occur. Analyzing millions of tickets sold, we arrived at this:

Chart: An aggregate, indexed view of music festival ticket sales over time. Source: Gupta Media's TallyTickets.com, 2025.

At left, we see the massive sales volume driven by on-sale announcements. That steep aggregate curve is being driven by about 30% of festivals which come out of the gate extremely hot. Typically, these quick-start examples are festivals that announce the full lineup and put all ticket types on-sale right away. The three smaller spikes between the 9% and 15% mark of the sales cycle? Those are driven by festivals that use a staggered pre-sale to push multi-day passes first, and then see big jumps when they place single-day tickets on-sale. The smaller spikes in the middle of the curve are often driven by scarcity tactics such as ticket-price increases.

The final acceleration is in part a natural dynamic of music festivals, and smart marketers keep tactics and resources in reserve for the big push to the finish. Even if you’ve done your job—generating awareness and educating the audience throughout the sales cycle—many of your edge-case fans will be on the fence until late in the game.

For months leading up to the event, a fan’s schedules and priorities are shifting and coming into focus—they may not want to lock up their plans for a big weekend (if your festival takes place around a holiday like Memorial Day) any sooner than necessary. When push comes to shove — about two weeks ahead of the event — you want them to believe your festival is the best option. For most consumers, there’s no rush to buy a ticket unless they believe the festival will sell out, or for some value-conscious buyers, if there’s a ticket-price increase coming. Absent those incentives, the best day to buy for your 50-50 fan is the morning of the festival — they know their plans, the weather, and any last-minute cancellations (either by bands or by their concert-going friends). The consumer has all of the leverage until the moment the event starts.

Optimizing ticket sales during the long run of a music festival sales cycle is one part science, two parts art: Because of year-to-year changes in talent, the economy, and even the weather, past successes are at best a very rough guide to future performance. For most festivals, in most years, the real work begins after the initial on-sale ticket rush — to make tough decisions over the long haul, looking for key moments to drive revenue without overspending, so you still have resources in reserve to spend when fans enter the crucial consideration phase in the final countdown to the concerts themselves.

To help you win on the big stage, we surveyed the performance marketing experts behind some of the country’s biggest music festivals to find out their keys insights concerning on-sales, fan data, marketing moments, geo-targeting, and more.

When Email Isn't Enough: How To Collect the Right Music Festival Fan Data

Festival marketers may overestimate the impact of repeat attendees—but that doesn’t mean we disregard the festival’s core fanbase. If you’re an established festival, you’ll likely start your season with a mailing list of past attendees — but having just an email address isn’t enough anymore. If you want to reach your fan base at precisely the right time, communicating via SMS instead of email is crucial: Text open rates are close to 99%, compared to the 20-40% open rates generally seen from emails.

How do you collect a fan’s phone number? Provide a return for the consumer. Platforms like Attentive have made it easier to capture a phone number to go along with the email—but the more important tactic is finding the right incentive at a key moment. One great time to ask for a phone number? When you’re offering early access to an exclusive pre-sale, while tickets are at their lowest price. In exchange for an on-sale code backed with premium value, fans will be more likely to sign up with a text. And in turn, our data shows they’ll be more likely to purchase tickets during your incentivized pre-sale period.

The New KPI You Need: Cost Per Ticket Day

Having one primary KPI can help parse through the data of a campaign and identify what really matters.

For the country’s top music festival promoters, we largely focus on Cost Per Ticket Day (CTD), where one Ticket Day is equal to one person going to the festival for one day. (For example: One fan purchasing two three-day passes would count for six Ticket Days.) We calculate Cost Per Ticket Day by dividing the total cost for all paid activity by the total number of ticket-days sold. This metric allows you to set a do-not-exceed limit on Cost Per Ticket Day for each day of the campaign—ensuring you never spend more budget than makes sense. It also reveals trends that metrics like CPA and even AOV can actually obscure. (CPA for a 3-day ticket shouldn’t be measured against CPA for a single-day pass; AOV often doesn’t take into account incremental revenue from merchandise, food, and other ancillaries.) More importantly, Ticket Days provides a better predictor of how each individual day of your festival is selling.

We built our advanced festival-analytics tool, Tally, to drill down so we can display Ticket Day sales and Cost Per Ticket Day down to the hour, so you can compare where your sales stand in comparison not just to prior years, months, or weeks, but to days and day-parts. Why does that matter? Because during crunch time—those do-or-die days at the beginning and end of the cycle—you don’t have time to wait for the day to end before you decide to adjust your spend.

Know Where Your Fans Are.

Be precise with your geo-targeting: Know your markets down to the zip code and don’t waste your ad dollars elsewhere.

It’s tempting to see a few sales coming from a big market six hours away and decide to run ads in that market because you know the size. But what we often find is that your Cost Per Acquisition in those markets won’t make sense to try to scale. If you do decide to target fans in those markets, we recommend using only your bottom-funnel ads. The strategy here: Wait for people to get deep into your funnel organically from that market, then start reaching them with paid ads. But trying to fill the top of your funnel in bigger, distant areas is a recipe for wild inefficiency.

Know Why Your Fans Want To Attend.

Whether a consumer is a returning buyer or a first-time attendee, knowing why they might attend is key for determining the messaging with which you’ll target them.

If a fan bought VIP passes in the past, show them a VIP or Platinum ad this year—not General Admission. If a fan visited your FAQ site, show them an ad that highlights on-site convenience, travel instruction, or pricing options. If they are a fan of a particular performing artist, show them an ad that speaks to their fandom—and not an ad about food and beverage options.

Create More Meaningful Moments.

Festival ticket-sales cycles are long—the average sales cycle in Tally is 167 days. But festivals generally have only a few built-in Big Moments that generate spikes in sales: Your on-sale date, the day single-day tickets go on-sale, the dates for price increases, and the final build-up. Understanding how to maximize those moments is key.

But you can also increase your efficiency by finding ways to create new moments — even small ones — to cultivate a sense of urgency among festival-goers. Whether these surges of interest are developed around holidays, artist moments, or even the weather, give your consumers more incentives to purchase earlier, and take away the risk of them not purchasing at the end.

How To Create The Perfect Barrier Buster

In the fast-paced world of music festival promotion, the only constant is change: Your marketing team needs to consistently test new creative and adjust the messaging to reach the right people at the right time. At the top of the funnel, your creative might be lifestyle-, experience-, or artist-based. And at the bottom of the funnel, you might need to push harder with a barrier buster—a tactic to get people past the final hurdle to purchase. Understanding buyers and their purchase patterns can ensure the creative and targeting are aligned. Typically, our clients see the most success with these three tactics, but note that each has its own risk-reward tradeoff:

Ticket Price Increase: After the initial rush of on-sales, the next incentive to buy for in-market fans is messaging that early-bird offers are about to expire. While we often see festivals offering discounted prices early in the cycle and then raising prices, it’s rare that we see promoters offering price decreases. Why? We generally find that promoters are wary of consumer backlash from fans who bought full-price tickets early and then see offers for cut-rate discounted tickets—which could suppress ticket sales in subsequent years, since fans might hold out if they think a better deal is coming later in the cycle.

No Fees: Although promoters are wary to offer ticket discounts (see above), we’ve seen creative solutions from festivals that offer “no added fees” for a limited window—perhaps a weekend. The messaging plays into a pain point for concert-goers and offers a nudge for fans who might be on the fence.

Lay-Away Pricing: Though it can be a polarizing topic among festival promoters, we’ve seen an increase in festivals that offer fans the option of putting a small amount down to secure tickets, with full payment due incrementally over time. Messaging around the availability of lay-away plans has the benefit of making tickets accessible to wider audiences, and also opens up opportunities for scarcity messaging—for instance, when lay-away pricing is ending, fans will be incentivized to purchase sooner.

The Conversion Game: Knowing When To Retarget

Sometimes, Music Festival marketing is science—and sometimes it’s an art. Part of the art is learning how to let earned, owned, and organic social carry their own weight.

Once you’ve triggered a digital campaign, there’s a tendency to overcompensate: Why isn’t everybody converting right now? But naturally, if you’ve created a proper full-funnel campaign, not all of your fans will be ready to transact. Your audience needs time to make a decision—and, as is often the case for fans attending a festival together, time to coordinate with others—before deciding to take the plunge.

If you retarget your ad 10 minutes after they leave the site, you’re hitting them too soon: It won’t be as impactful as waiting 24-48 hours. Let your conversions get picked up by organic social or email, if needed—and then, once they’ve had time to build desire, engage. In the meantime, you’ll be saving budget for the times when you’ll really need it: Driving incremental sales, and preparing for the last-mile sales rush in your final weeks.

The lazy festival marketer chases bottom-funnel retargeting numbers; the smart marketer invests in a full-funnel approach. If all you’re doing is looking at what drives the highest return on ad spend (ROAS) based on the attribution reports in your ad platforms, then site retargeting will always win. But we often ask festival marketers to think deeper: What percentage of that revenue is incremental? How much would you have won even if you hadn't spent those ad dollars? Spending more money at the top of the funnel will have a lower ROAS, but higher incrementality. And your incremental audience will pay dividends in the future, too—creating more awareness of your event, even if it doesn’t always show up in your dashboard on Day 1.

How To Expand Your Reach: Don't Get Lost At the Bottom of the Funnel

It’s easy to continuously target the bottom of the funnel and point out how great your Return on Ad Spend (ROAS) is. However, that last-mile mentality isn’t bringing in the incremental sales you’ll need to allow your campaign to scale. Consistently monitoring your reach and frequency can help find ways to target new audiences during your flight. This ties back to the Cost Per Ticket Day KPI. While your bottom-funnel ROAS may be terrific, if you aren’t moving more tickets, the number won’t support scaling spend.

How To Drive Incremental Revenue from a Sell-Out Music Festival

For promoters, the ultimate sales goal is a sell-out. But for some of our clients, a sell-out doesn’t mean the job is 100% done.

First, not all sell-outs are treated equally. Is every ticket or package completely sold out, or just the General Admission options? The disappearance of GA tickets—taking the ‘standard’ festival experience off the table for fans—can be a powerful lever to push VIP experiences, premium ticket options, and other add-ons. Once GA is sold out, a VIP ticket might be the only way for a superfan or last-minute buyer to attend the festival, see the lineup, and experience everything that the event has to offer.

And remember: There’s always next year. A festival sell-out this year creates an opportunity to invest in your next event. Sellouts create powerful social capital and drive serious FOMO amongst those who didn’t pull the trigger on a ticket this year until it was too late. The key? Rub it in.

We have historically seen a high volume of engagement from boosting “sold out” assets or promoting the “on-site” experience of the festival while it’s actively happening. And while some of that engagement targets those on-site, it’s also a signal to those who aren’t. Leveraging FOMO into user comments and tags of their friends creates more incentive to buy earlier in the festival cycle next year, while also building pools of in-market fans for next year. This type of activation can even be paired with a CRM/lead-form collection campaign to hyper-charge your audiences for next year.

Gupta Media music-festival veterans Joe Schlesinger and Billy Philhower contributed research and expertise to this report. Data and modeling support by Jordan Maddocks and Aram Donabed from Gupta Media's Strategy & Analytics team, with additional data and engineering support from Gupta Media's Chief Architect Jason Frank. Data visualization and design by Aram Donabed and Gupta Creative's Lisa DeMoranville.

Festival Analytics, Simplified!

Tally is the ticketing analytics platform designed so you never miss a beat. Track, analyze, and forecast your way to a sold-out event every time. Get started for free.

- Clarity Through Simplicity: All your ticketing data, all in one place.

- Turn Insights Into Strategy: View reporting by the hour, week, or ticket type to get a clear picture of your sales trends.

- Forecast with Confidence: Tally's advanced modeling allows you to chart your course towards a sell-out. Make informed marketing and advertising decisions based on Tally's sophisticated analytics.