The true cost of social media ads in 2025

Drawing on an analysis of tens of billions of ad impressions, Gupta Media's State of Social Media CPM Report is the definitive guide to the cost of paid social media ads on Facebook, Instagram, TikTok, Snapchat, YouTube, and more. Uncover ad-rate trends, seasonal fluctuations, and valuable cost-saving tactics for your marketing strategy.

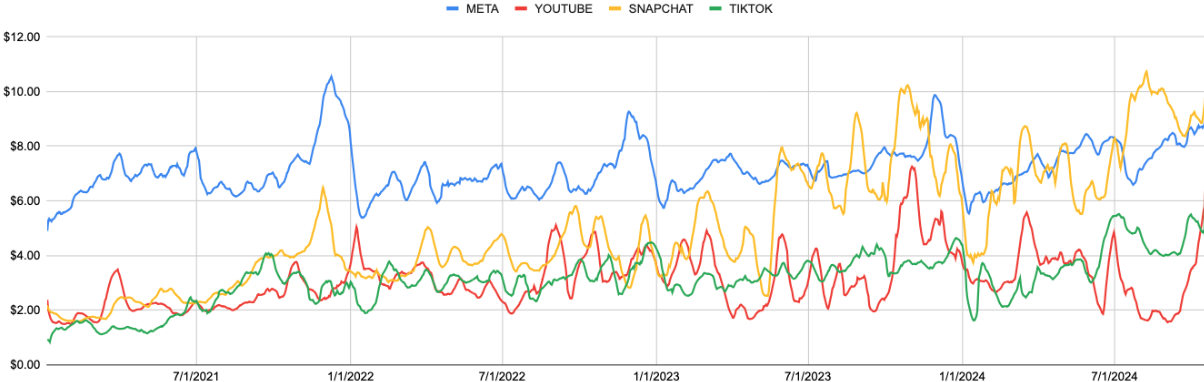

Chart: Social Media Ad Rates, 2021-2024, using 14-day trailing average CPM rates for Meta, TikTok, Snapchat, Spotify, and YouTube. Source: Gupta Media's Social Media CPM Tracker, where you can track and compare real-time and historic fluctuations in Social Media CPMs, including CPM rates for Instagram Reels, Instagram Stories, Google Discovery, Google Performance Max, and Pinterest.

We examined CPM rates across the top social media platforms and tens of billions of ad impressions to deliver precise insights on how and when CPM rates rise and fall over the course of the year. In our second annual report, we break down the seasonal and year-over-year trends in social media ad costs—allowing marketing professionals to set benchmarks for their campaigns, plan budgets, unlock unexpected value, and anticipate seasonal cost fluctuations that can sidetrack your paid-media efforts during key parts of the year.

While CPM (cost per thousand impressions) is just one metric among many used to measure the cost of high-impact marketing performance, it’s a bellwether for both investors and advertisers to understand the relative values and costs associated with a platform. When a platform’s CPM rate tumbles—as it did for Twitter/X after being bought by Elon Musk in 2023, or as it did for Facebook during the COVID lockdown in 2020—its revenue tends to fall as well. And when CPM rates soar—as they typically do around Black Friday and Cyber Monday—marketers need to adjust the efficiency of their advertising in order to hit their goals.

TABLE OF CONTENTS

This year, we mapped and analyzed seasonal variations in CPM rates for Facebook, Instagram, TikTok, Snapchat, and YouTube. For each platform, we present data-backed answers on questions including:

- What are the most and least expensive days, weeks, and months of the year for social media CPMs?

- Are CPM rates rising or falling year over year? And are they rising or falling more quickly than in previous years?

- What social media platforms provide the most value for your paid-media spend during high-impact seasons such as Black Friday, Cyber Monday, and the Q4 holiday season?

- What impact did the 2024 elections have on CPM rates?

Among our most surprising findings:

- Facebook and Instagram ad rates were down year-over-year during the first three months of 2024—a trend that ran contrary to numerous media reports of Meta ad inflation in Q1. Meta’s ad rates for 2024 are up just 1% year-over-year to date.

- By far the fastest-rising social media ad rates belong to Snapchat, whose CPM is up 27.6% year-over-year to date.

- Holiday ad rates are soaring. Competition for consumer attention in November and December—specifically around Black Friday and Cyber Monday—is driving seasonal CPM increases by as much as 66% during the holiday shopping season.

- Social Media advertisers can find hidden value just before BFCM. With consumers starting their holiday shopping earlier than ever, our data shows a new period where relatively low CPM rates coincide with elevated consumer intent. Based on an analysis of this data, there’s an opportunity for advertisers to “jump start” the holiday shopping season just before Black Friday/Cyber Monday.

This study follows on the work of our groundbreaking Social Media CPM Tracker, launched just months into the COVID-19 lockdown. In our 2020 research, cited by the New York Times, Reuters, Goldman Sachs, Guggenheim Partners, and others, we surfaced data on the plunging ad rates on Facebook. In the ensuing years, we extended our real-time data sets to include advertising rates for platforms including Instagram, TikTok, Twitter/X, Google, LinkedIn, Snapchat, and Pinterest.

In 2023, for the first time, we published a state-of-the-art report that examined trends in CPM rates across the industry—digging into seasonal fluctuations, differences between platforms, and uncovering insights that can help advertisers and agencies plan ahead to make more efficient use of their media budgets. And now, in 2025, we’ve expanded our report to include targeted deep-dives into complex platform mechanics that are guiding our strategies and tactics as performance marketing evolves in the age of AI and machine learning.

Drawing on tens of millions of ad impressions over a range of industries, we calculated the average CPM rates for the top social media platforms. In 2025, the average annual CPM rates are as follows:

|

PLATFORM |

2025 AVG CPM RATE |

|

Meta (Facebook & Instagram) |

$8.15 |

|

TikTok |

$2.97 |

|

YouTube |

$2.16 |

|

Snapchat |

$6.43 |

|

|

$6.03 |

For each social media platform, CPM rates, cost per link click (CPLC) rates, and link clickthrough (LCTR) rates can change drastically throughout the year. To help brands, agencies, and advertisers to anticipate seasonal fluctuations, we investigated the average CPM rates for each social platform over the course of the past four years.

Since CPM rates change dramatically from month to month—and sometimes from week to week, or day to day—to truly understand the shape of CPM rates on social media, we need to ask a better question: When are CPM rates higher or lower?

As you can see in the chart at the top of this page, some platforms conform to similar seasonal patterns—while others follow an internal logic all their own.

To better understand CPM rates in 2024, we broke down the data on each platform to unlock insights on how ad cost can change not just from year to year, but over the course of your campaigns.

How much do Facebook and Instagram ads cost in 2025?

In February 2025, the average CPM for Meta (Facebook and Instagram) is currently $7.75. The average CPLC is $0.90. And the average LCTR is 0.86%.

|

Meta, January 2025 |

Avg. CPM: $7.75 |

Avg. CPLC: $0.90 |

Avg LCTR: 0.86% |

Table: Facebook and Instagram Current Advertising Costs, Updated in February, 2025. Source: Gupta Media Social CPM Tracker 2024.

Facebook and Instagram, the pioneers in social-media advertising, remain the standard against which other platforms are measured—providing brands with a potent combination of reach, engagement, and precision targeting. With their combined strengths, advertising on these platforms offers a multifaceted approach to performance marketing, ensuring that brands can remain front and center in the ever-evolving digital landscape.

While Facebook has transformed the way we connect, communicate, and share, Instagram has emerged as the premier platform for visual storytelling, lifestyle inspiration, and influencer-led content. Meta’s combined granular targeting capabilities—leveraging user data like demographics, interests, and behaviors—ensure that brands can reach the precise audience they aim for. This makes ad spend more efficient and results more relevant. Driven by advertiser demand, Meta’s ad platforms have continued to evolve with new features and focus. With Instagram's Shop feature and Facebook's Marketplace, the path from discovery to purchase is more streamlined than ever. Brands can directly drive sales from their ads, offering users a frictionless shopping experience.

The synergies between Facebook and Instagram mean that brands can create integrated campaigns that flow seamlessly across both platforms, optimizing reach and engagement. Beyond mere advertising, these platforms enable brands to build and nurture communities. Engaging content, coupled with ads, fosters brand loyalty and turns customers into brand advocates. And both Instagram and Facebook offer detailed insights and analytics, allowing brands to measure their campaign performance in real-time, understand user engagement, and refine strategies based on direct feedback.

The most expensive month for Facebook and Instagram ads is December. The most expensive day of the week for Facebook and Instagram ads is Friday, with an average $7.43 CPM. The most expensive week of the year for Facebook and Instagram is the week of Thanksgiving and Black Friday — in 2024, that was ISO week 48, with an average CPM of $13.42. That was followed by Week 49 — which in 2024 included Cyber Monday — with a CPM of $12.53, and Week 50 (December 9-15), with a CPM of $11.03.

While multiple news reports in the spring of 2024 claimed Meta was experiencing ad-rate inflation, the numbers tell a different story. See “Are Social Media Ad Rates Rising or Falling?” below for a deeper discussion of the rate of growth in Meta’s ad rates as compared with other social platforms—and compared to historical Meta ad rate growth and fluctuation.

|

MONTH |

Meta Avg CPM |

Meta Avg CPLC |

Meta Avg LCTR |

|

January 2025 |

$8.27 |

$0.82 |

1.01% |

|

December 2024 |

$10.83 |

$0.98 |

1.11% |

|

November 2024 |

$9.61 |

$0.84 |

1.14% |

|

October 2024 |

$8.94 |

$0.71 |

1.25% |

|

September 2024 |

$8.30 |

$0.81 |

1.02% |

|

August 2024 |

$7.95 |

$0.82 |

0.97% |

|

July 2024 |

$7.05 |

$0.75 |

0.94% |

|

June 2024 |

$8.11 |

$0.92 |

0.89% |

|

May 2024 |

$8.06 |

$0.93 |

0.87 |

|

April 2024 |

$7.29 |

$0.68 |

1.08% |

|

March 2024 |

$7.33 |

$0.79 |

0.93% |

|

February 2024 |

$6.57 |

$.059 |

$1.10 |

|

January 2024 |

$6.05 |

$0.72 |

0.84% |

|

December 2023 |

$7.62 |

$1.24 |

0.62% |

|

November 2023 |

$8.80 |

$1.09 |

0.81% |

|

October 2023 |

$7.62 |

$1.03 |

0.74% |

|

September 2023 |

$7.65 |

$0.90 |

0.85% |

|

August 2023 |

$7.03 |

$0.78 |

0.90% |

|

July 2023 |

$6.98 |

$0.96 |

0.73% |

|

June 2023 |

$7.30 |

$0.89 |

0.82% |

|

May 2023 |

$7.05 |

$0.74 |

0.96% |

|

April 2023 |

$6.89 |

$0.82 |

0.84% |

|

March 2023 |

$7.58 |

$0.63 |

1.20% |

|

February 2023 |

$6.74 |

$0.54 |

1.25% |

|

January 2023 |

$6.21 |

$0.63 |

0.98% |

|

December 2022 |

$7.41 |

$0.73 |

1.02% |

|

November 2022 |

$8.28 |

$0.67 |

1.24% |

|

October 2022 |

$6.77 |

$0.83 |

0.82% |

|

September 2022 |

$6.73 |

$0.86 |

0.79% |

Table: Meta’s average monthly CPM, cost per link click (CPLC), and link click-through rate (LCTR), September 2022-January 2025. Source: Gupta Social Media Tracker.

How much do TikTok ads cost in 2025?

In February 2025, the current average CPM for TikTok is $3.48. The average CPLC is $0.50. And the average LCTR is 0.69%.

|

TikTok, February 2025 |

Avg CPM: $3.48 |

Avg. CPLC: $0.50 |

Avg. LCTR: 0.69% |

Table: TikTok Current Advertising Costs, updated in February, 2025. Source: Gupta Media Social CPM Tracker.

TikTok’s popularity continues to grow, transforming from a hub for short-form videos into one of the world's most engaging and dynamic platforms. For brands seeking to amplify their reach and resonate with a young, tech-savvy audience, advertising on TikTok has moved from a nice-to-have to a priority. Rooted in creativity, authenticity, and user participation, TikTok allows brands to tap into trends, challenges, and user-generated content, offering a more organic and engaging way to promote products and services.

Not only is TikTok’s user base growing, but it boasts an engaged audience actively searching for the next big thing. GenZ and Millennials make up over half of TikTok’s 148 million monthly active users, and its audience skews both younger and female. Thanks to an algorithm that prizes virality, brands that craft compelling, trend-worthy content have the chance to be showcased to a massive audience, often beyond their target demographic. TikTok's advertising platform allows brands to pinpoint their ideal audience based on demographics, behaviors, interests, and more.

The most expensive month for TikTok ads in 2024 was October, with an average CPM of $5.84. The most expensive day of the week for TikTok ads is Wednesday, with an average $3.93 CPM. The most expensive week of the year for TikTok in 2024 was week 49, which included Thanksgiving and Black Friday, with a $6.89 CPM.

|

MONTH |

TikTok Avg CPM |

TikTok Avg CPLC |

TikTok Avg LCTR |

|

January 2025 |

$2.87 |

$0.38 |

0.76% |

|

December 2024 |

$4.90 |

$0.68 |

0.73% |

|

November 2024 |

$5.11 |

$0.62 |

0.83% |

|

October 2024 |

$5.84 |

$0.56 |

1.05% |

|

September 2024 |

$4.75 |

$0.71 |

0.67% |

|

August 2024 |

$4.05 |

$0.49 |

0.83% |

|

July 2024 |

$4.97 |

$0.58 |

0.85% |

|

June 2024 |

$4.77 |

$0.74 |

0.65% |

|

May 2024 |

$3.44 |

$0.30 |

1.13% |

|

April 2024 |

$3.41 |

$0.24 |

1.44% |

|

March 2024 |

$2.89 |

$0.23 |

1.24% |

|

February 2024 |

$2.34 |

$0.17 |

1.19% |

|

January 2024 |

$2.25 |

$0.27 |

0.83% |

|

December 2023 |

$4.23 |

$0.29 |

1.45% |

|

November 2023 |

$3.69 |

$0.28 |

1.31% |

|

October 2023 |

$3.53 |

$0.33 |

1.06% |

|

September 2023 |

$4.12 |

$0.30 |

1.38% |

|

August 2023 |

$3.73 |

$0.23 |

1.64% |

|

July 2023 |

$3.30 |

$0.40 |

0.82% |

|

June 2023 |

$3.45 |

$0.26 |

1.31% |

|

May 2023 |

$3.49 |

$0.30 |

1.16% |

|

April 2023 |

$3.08 |

$0.32 |

0.96% |

|

March 2023 |

$2.89 |

$0.28 |

1.03% |

|

February 2023 |

$3.02 |

$0.27 |

1.14% |

|

January 2023 |

$2.76 |

$0.22 |

1.28% |

|

December 2022 |

$4.15 |

$0.46 |

0.90% |

|

November 2022 |

$3.14 |

$0.39 |

0.81% |

|

October 2022 |

$3.51 |

$0.50 |

0.71% |

|

September 2022 |

$3.46 |

$0.34 |

1.01% |

Table: TikTok monthly average CPM, CTLC, LCTR. Source: Gupta Media Social CPM Tracker February 2025.

In 2023, we saw TikTok lean into shopping. With features like "Shop Now" buttons and shoppable video links, brands gained the ability to drive direct sales from within the app, creating a seamless shopping experience. In 2024, TikTok focused on bringing ads to its search platform—a boon to brands seeking to move beyond Google and reach younger audiences where they hang out. Depending on who’s asking, anywhere between 10% (according to Adobe) and 51% (according to HerCampus) of Gen-Z users prefer TikTok over Google for search. TikTok rolled out expanded search ads with keyword targeting in August 2024.

But our teams have found TikTok search advertising to be a mixed bag. A common theme is that search campaigns often return low volume—an uphill battle if you’re looking for scale. Post-click performance has been hit or miss, but generally Cost Per Click (CPC) costs are higher for search than for in-feed ads—so your post-click performance needs to be even stronger to make up for that difference.

How much do Snapchat ads cost in 2025?

In February 2025, the current average CPM for Snapchat is $10.47. The average CPLC is $1.75. And the average LCTR is 0.60%.

|

Snapchat, February 2025 |

Average CPM: $10.47 |

Average CPLC: $1.75 |

Average LCTR: 0.60% |

Table: Snapchat's average CPM, CPLC, and LCTR, updated February, 2025. Source: Gupta Social Media CPM Tracker.

In 2024, Snapchat re-emerged as a breakout platform for brands looking to engage with a younger, highly interactive audience. With its unique ad formats, including augmented reality (AR) lenses and interactive story ads, Snapchat offers brands a creative playground to capture attention in innovative ways. Unlike more traditional social platforms, Snapchat’s ad offerings are built around the concept of engaging, immersive experiences that align seamlessly with the app’s core user behaviors: quick, visually-driven interactions.

Snapchat’s ad rates were the fastest-growing of any social media platform we measured in 2024, with CPM rates rising 47% year over year.

The most expensive month for Snapchat ads in 2024 was October, with an average CPM of $10.48. The most expensive day of the week for Snapchat ads is Thursday, with an average $7.91 CPM. The most expensive week of the year for Snapchat in 2024 was week 42 (October 14-20), with a $12.00 CPM.

|

MONTH |

CPM |

CPLC |

LCTR |

|

January 2025 |

$10.47 |

$1.75 |

0.60% |

|

December 2024 |

$8.85 |

$1.93 |

0.46% |

|

November 2024 |

$9.91 |

$1.66 |

0.60% |

|

October 2024 |

$10.48 |

$0.93 |

1.13% |

|

September 2024 |

$8.85 |

$1.12 |

0.79% |

|

August 2024 |

$9.96 |

$1.21 |

0.82% |

|

July 2024 |

$9.48 |

$1.13 |

0.84% |

|

June 2024 |

$7.10 |

$1.07 |

0.66% |

|

May 2024 |

$6.11 |

$1.16 |

0.53% |

|

April 2024 |

$7.53 |

$0.79 |

0.96% |

|

March 2024 |

$7.69 |

$0.62 |

1.24% |

|

February 2024 |

$6.73 |

$0.47 |

1.43% |

|

January 2024 |

$3.96 |

$0.30 |

1.32% |

Table: Average monthly CPM, CPLC, and LCTR for Snapchat, 2024-2025. Source: Gupta Social Media CPM Tracker.

Why are Snapchat ads so expensive?

We believe this is the untold story of the year—and not nearly enough agencies are talking about the platform’s CPM growth, nor the implications for marketers.

Our first takeaway: Snapchat isn’t just for awareness anymore. As the platform has matured, advertisers now have the ability to optimize for more than just impressions. And that added targeting ability is driving up CPMs—making it very, very expensive.

In fact, in 2024 Snapchat became too expensive for some of our media plans—in one example, CPM rates were two to four times higher than made sense for the campaigns. In another example, where we were able to look at an apples-to-apples analysis for a campaign focused on awareness metrics—conducted with over $1 million in ad spend, in multiple countries—we saw Snapchat’s CPM come in at nearly 3x all other platforms. And the results were generally not worth the premium: When using link tagging, we saw Meta driving a 13x stronger (that’s not a typo: 13x) conversion rate than Snapchat.

How much do YouTube ads cost in 2025?

In February 2025, the current average CPM for YouTube is $2.89.

Even with stiff competition from TikTok and Instagram’s Reels, YouTube reigns as the undisputed king of video streaming. In both form and content, it has not only redefined entertainment but has also sculpted new pathways for information dissemination, education, and branding. Boasting billions of views daily, the platform intertwines diverse global cultures, interests, and demographics under one digital roof. In May 2024, “YouTube made up nearly 10% of all viewership on connected and traditional TVs in the U.S.,” according to Nielsen—the largest share ever reported by a streaming platform. As interest in CTV explodes, YouTube is at the front of the pack.

The most expensive month for YouTube ads was December, with an average $5.70 CPM. The most expensive day of the week for YouTube ads is Monday, with an average $3.53 CPM. The most expensive week of 2024 for YouTube was ISO Week 50, which included Cyber Monday, with a CPM of $6.93.

|

MONTH |

YouTube Avg. CPM |

|

January 2025 |

$1.98 |

|

December 2024 |

$5.70 |

|

November 2024 |

$4.73 |

|

October 2024 |

$4.70 |

|

September 2024 |

$2.81 |

|

August 2024 |

$1.76 |

|

July 2024 |

$2.19 |

|

June 2024 |

$3.61 |

|

May 2024 |

$3.65 |

|

April 2024 |

$3.87 |

|

March 2024 |

$4.66 |

|

Feb. 2024 |

$2.87 |

|

Jan. 2024 |

$2.99 |

|

Dec. 2023 |

$4.06 |

|

Nov. 2023 |

$4.93 |

|

Oct. 2023 |

$5.72 |

Table: Average monthly CPM for YouTube, updated February 2025. Source: Gupta Social Media CPM Tracker.

What are the most expensive and least expensive days of the week for social media ads?

Seasonal fluctuations generally have a much bigger impact on CPM cost than the day of the week. But, we wondered: Does day matter? We crunched the numbers to find out the relative cost for each day of the week on each social platform.

Table: Meta (Facebook and Instagram) average CPM by day of the week, 2024. Source: Gupta Media CPM Tracker.

|

Weekday |

Meta Avg. CPM |

Meta Avg. CPLC |

|

Monday |

$6.79 |

$0.73 |

|

Tuesday |

$7.06 |

$0.72 |

|

Wednesday |

$7.28 |

$0.73 |

|

Thursday |

$7.39 |

$0.75 |

|

Friday |

$7.43 |

$0.77 |

|

Saturday |

$7.25 |

$0.73 |

|

Sunday |

$7.15 |

$0.73 |

Table: TikTok average CPM by day of the week, 2024. Source: Gupta Media Social CPM Tracker.

|

Weekday |

TikTok Avg. CPM |

TikTok Avg. CPLC |

|

Monday |

$3.88 |

$0.42 |

|

Tuesday |

$3.95 |

$0.41 |

|

Wednesday |

$3.98 |

$0.41 |

|

Thursday |

$4.83 |

$0.43 |

|

Friday |

$3.93 |

$0.42 |

|

Saturday |

$3.63 |

$0.39 |

|

Sunday |

$3.69 |

$0.39 |

Table: Snapchat average CPM by day of the week, 2024. Source: Gupta Media Social CPM Tracker.

|

Weekday |

Snapchat Avg. CPM |

Snapchat Avg. CPLC |

|

Monday |

$7.68 |

$0.88 |

|

Tuesday |

$8.01 |

$0.86 |

|

Wednesday |

$7.92 |

$0.84 |

|

Thursday |

$8.52 |

$0.78 |

|

Friday |

$8.00 |

$0.75 |

|

Saturday |

$7.55 |

$0.70 |

|

Sunday |

$7.45 |

$0.73 |

Table: YouTube average CPM by day of the week, 2024. Source: Gupta Media Social CPM Tracker.

|

Weekday |

YouTube Avg. CPM |

YouTube Avg. CPLC |

|

Monday |

$3.45 |

$2.62 |

|

Tuesday |

$3.48 |

$2.64 |

|

Wednesday |

$3.48 |

$2.63 |

|

Thursday |

$4.06 |

$3.50 |

|

Friday |

$3.17 |

$2.44 |

|

Saturday |

$2.97 |

$2.34 |

|

Sunday |

$3.12 |

$2.43 |

With the exception of a multi-year downturn due to the COVID-19 lockdown, CPM rates have tended to rise year-over-year. To help predict future trends, we wanted to understand which social-media platforms are experiencing the fastest growth in CPM rates, and which platforms are experiencing decline. The chart below looks at average CPM rates for successive trailing-12-month periods going back to 2021.

Chart: Year over year change in CPM rates for Meta, YouTube, Snapchat, and TikTok, 2021-2024. Source: Gupta Social Media CPM Tracker, 2024.

Of all the social media platforms we measured, Snapchat stood out as the platform with the fastest growing rates. Snapchat’s CPM rates climbed 47% year over year. That was more than double the rate of any other platform. With the exception of Pinterest—where ad rates increased 16% year over year—no other platform saw more than a single-digit percentage increase in CPM rates.

At YouTube and TikTok, the rates of growth slowed compared to previous years. TikTok had the fastest-growing advertising rate in 2023, when CPM climbed 19%. This year, CPM rose by just 8%. At YouTube, CPM rate growth slowed from 7.5% in 2023 to just 2.4% in 2024.

Meta had the slowest CPM growth over the previous two years—just 3.7% in 2022, and 2.9% in 2023. But in 2024, growth jumped to 5%—still well below the growth rates of TikTok and Snapchat, but enough to make advertisers notice.

If, instead of looking at trailing-12-month figures, we simply compare year-to-date 2024 versus the equivalent time frame in 2023—an approach that omits the seasonally higher rates seen during holiday shopping season—the results are even more stark: Snapchat ad rates are up 27.6%, while TikTok is up 9.3% and Meta is up just 1%—while YouTube is down 2% and LinkedIn is down 16%.

Chart: Year-to-date, year-over-year change in CPM rates by percentage (January 1—October 1, 2023 vs. 2024). Source: Gupta Social Media CPM Tracker, 2024.

Chart: Year-to-date, year-over-year change in CPM rates by percentage (January 1—October 1, 2023 vs. 2024). Source: Gupta Social Media CPM Tracker, 2024.

Is Meta seeing ad-rate inflation in 2025?

In April 2024, several media outlets reported on what some in the industry described as Facebook ad-rate inflation. According to media buyers, “the cost of running ad campaigns is up significantly,” Bloomberg reported, “while results are mixed and ensuing sales are down.” One media buyer told the outlet that Meta’s CPM and CPC were up by 2-3x in Q1 2024; another said they’d seen ROAS drop 20-40% in the previous two months.

For agencies that are unfamiliar with seasonality in CPM rates, this fluctuation may have come as a surprise. But when we looked at the data, we saw ad rates rising almost exactly as they had in previous years. Just as in 2021, 2022, and 2023, in 2024 Meta CPM rates climbed between January and March. In fact, although rates climbed month over month, they were actually down year-over-year for the first three months of 2024.

Then, in April and May, we saw a deviation from the pattern: rates typically decline slightly in spring, but in 2024 they stayed even—representing a modest YOY increase. For the year to date, average Meta CPM in 2024 was up just $0.08 over 2023. It’s worth noting that CPM rates saw significantly higher YOY increases in August (+$0.92) and September 2024 (+$0.65). If that trend continues, the final year-over-year increase will almost certainly go up. But for media planners, looking at rate increases month-over-month as opposed to year-over-year is a mistake.

Chart: Meta (Facebook and Instagram) monthly average CPM rates, 2021-2024. Source: Gupta Social Media Tracker.

Chart: Meta (Facebook and Instagram) monthly average CPM rates, 2021-2024. Source: Gupta Social Media Tracker.

Based on our data, we believe that reports of Facebook and Instagram ad inflation were overstated early in 2024—when we observed Meta CPM rise month-over-month in accordance with seasonal patterns. But CPM rates have seen significant gains in Q2 and Q3 that have contributed to higher overall CPM growth.

Chart: 2024 year-over-year change in Meta ad rates, by month. Source: Gupta Social Media Tracker, 2025.

As we approached the 2024 election, political digital ad spend was set to break records. According to Emarketer, total spend was expected to exceed $3 billion, up 156% from 2020. Connected TV (CTV) dominated, claiming around 45% of digital spend, which equates to $1.56 billion—a 500% increase from 2020. Meanwhile, social media spend, heavily concentrated on Meta platforms, was projected to reach $605 million, growing slower than CTV but still surpassing 2020 figures significantly.

Historically, political advertising sees a massive surge in the final 30 days of the campaign season, with Basis predicting half of all political dollars in 2024 will be spent during this period. This late-cycle influx has the potential to drive up CPM rates, especially in battleground states where a heavier volume of ads is expected to compete for limited ad inventory.

According to AdImpact, 79% of presidential ad spending was concentrated in seven pivotal states from the time Vice President Kamala Harris officially entered the race. AdImpact predicted these same states—Arizona, Georgia, Michigan, North Carolina, Nevada, Pennsylvania, and Wisconsin—would capture 88% of ad buys between October 2024 and Election Day.

The impact on ad rates—while difficult to predict—depends on both geography and platform. TikTok, for instance, has said it does not predict that its CPM rates to be impacted, for one simple reason: TikTok doesn’t officially allow campaign advertising. But that reasoning doesn’t account for the more complex cross-platform dynamics at work. For instance, with political dollars flooding TV and CTV, traditional advertisers may find themselves displaced or priced out of those markets — resulting in a knock-on migration to more affordable mobile-video-friendly platforms like TikTok.

Google, too, is poised for substantial growth in political ad revenue, expected to capture over $500 million—more than double its 2020 earnings. This overall increase in digital ad spend, coupled with the rise in demand for CTV and Meta ads, will contribute to significantly higher CPM rates, particularly in contested regions. Basis, for instance, has suggested that rates could be as much as 40% higher as we near Election Day.

As it did in 2020, Google will pause election advertisements immediately after the polls close, creating a window during which “advertisers will be prevented from running ads in the U.S. referencing candidates, ballot measures, election processes and outcomes,” according to Politico.

Still, a backlog of shopping ads—those being displaced by the deluge of campaign ads flooding CTV during an accelerated holiday season—could cause elevated CPM rates to continue after the election concludes, as heightened demand overflows into mid-November and December. For instance, Hulu’s ad rates are expected to rise between 16% and 44% between November 11 and December 2, well after the election spend subsides.

For brands with ads in-market for swing states — or anyone contemplating large-scale CTV buys in Q4 — it’s not too late (yet) to seek relief by booking in advance. But for those hoping to “wait out” the election storm in the hopes of finding smoother seas on the other side, our guidance is that ad rates will likely continue to go up until late in the year.

While CPM rates vary throughout the year, the biggest seasonal swings—both up and down—tend to occur in relation to Q4. The holiday season—encompassing major events like Hanukkah, Christmas, Thanksgiving, New Years, and other cultural celebrations—is a period of increased consumer spending and heightened advertising demand. During this time, CPM rates tend to rise as advertisers compete for limited ad inventory. Businesses aim to capture the attention of consumers who are actively engaged in shopping and holiday-related activities. As a result, the competition for ad impressions escalates, leading to higher CPM rates.

Most marketers know that CPM rates skyrocket for Black Friday and Cyber Monday, as well as during the December holidays, and then quickly fall in early January. The details of those trends vary by platform, but savvy advertisers understand that Q4 has its own shape and characteristics, distinct from the rest of the year. In just the past year or two, platforms like Meta and TikTok have begun to introduce an additional concept, which is being called “Q5”—a so-called “fifth quarter” to the year— to describe an opportunity for marketers that exists either just after the holiday season, or during a lull in the action between Cyber Monday and the December holiday rush.

Understanding exactly when those rates tend to go up, and by how much, is key to planning an effective advertising campaign around the most popular online shopping days of the year. We looked at data going back to 2021 to understand, in granular detail, when CPM rates tend to rise on each platform.

How much do Facebook and Instagram ads cost on Black Friday and Cyber Monday?

Cyber Monday (December 2, 2024) was the single most expensive day of the year for ad rates on Meta, with a CPM of $17.70—that’s 138% more expensive than Meta’s 2024 annualized average CPM rate of $7.43. Black Friday (November 29, 2024) was the second most expensive day of the year for ad rates on Meta, with a CPM of $16.85.

The week including Black Friday — ISO Week 48 (November 25-December 1) — was the most expensive week of the year, with an average CPM of $13.42. It was followed closely by ISO Week 49 (December 2-8), with an average CPM of $12.53, driven by Cyber Monday.

For Facebook and Instagram CPMs, the difference between the weeks of BFCM and the rest of the holiday season is striking, as the weeks directly before and after BFCM saw CPMs between 12% and 27% cheaper.

How much do TikTok ads cost on Black Friday and Cyber Monday?

TikTok’s CPM on Black Friday (November 29, 2024) was $6.26. TikTok’s CPM on Cyber Monday (December 2, 2024) was $6.28

In recent years, TikTok CPMs tended to rise well into December, eclipsing its BFCM prices—while Meta's rates tended to drop. For instance, the most expensive day of 2023 for TikTok came on December 20, with an average CPM of $5.04. In 2024, with TikTok maturing as an ad platform, its CPM patterns have begun to mirror those of Meta and other platforms.

Why should brands pay higher CPM rates in Q4?

When investing in paid social media advertising on Black Friday, marketers have two strikes against them. First, increased ad costs: CPM rates are likely the highest they’ll be all year. And second, because products are often discounted to compete with other sales, there’s also a potential for a decline in margins and/or average order value (AOV).

So in order for increased CPMs to be worth the spend, advertisers need two things to happen. To keep their cost per acquisition (CPA) on track, they need their conversion rates to improve. And they also need a strategy in place to encourage consumers to purchase more in order to deliver on revenue targets.

How much more expensive are social media ads during Q4?

Buyers of TikTok and Meta ads pay a premium during the Q4 holiday season when ad rates rise. We calculate that difference by comparing the CPMs in Q4 to CPMs in Q1 through Q3. What we saw in 2022 was that TikTok’s Q4 premium was 22%, as compared with earlier in the year. On Meta, that premium was only 13%. Similarly, in 2023 we saw TikTok’s Q4 premium was 30%, compared with Q1-Q3. On Meta, the 2023 premium was 17%.

Are TikTok Ads Cheaper During Q4?

While TikTok CPMs have consistently been on the rise, the platform is still in its infancy relative to its competitors. Year-to-date, TikTok ads are 47% more efficient than Meta ads.

But will that number hold up during the hyper-competitive Q4 holiday season? We believe it will: last year, between October 1 and December 31 of 2023, TikTok ads were 52% cheaper, on average, than Meta’s.

Just because TikTok ads are cheaper doesn’t mean they’re more effective. More sophisticated platforms like Meta and Google still reign during the holidays when it comes to harnessing a powerful algorithm designed to reach the users most likely to make it across the purchasing finish line.

But TikTok’s efficient CPMs present an opportunity for smart advertisers: With a combination of the right audience, the right conversion rate, and the right creative—typically native to the platform, and user-generated—there’s an opportunity to save big with a heightened share of spend on TikTok compared to Meta.

Tips for Advertising on TikTok During Q4

In short: Start now, because optimizing TikTok campaigns takes time.

One of the biggest limitations of a conversion-optimized TikTok campaign is that the platform’s pixel can only learn from attributed events. There’s a bit of a paradox here: It means your campaign needs to drive conversions . . . before the pixel can learn how to drive conversions.

How does that impact your Q4 campaigns? If you’re planning to place a big bet on TikTok around the holiday season to reach users more cheaply than Meta, you’ll need to start training the pixel now. This way, the pixel will have enough attributed events to execute a fully conversion-optimized approach when it matters — i.e., when CPMs are at their most efficient.

Once upon a time, Black Friday was a retail jackpot: One shot, all-in. It hasn’t been that way for some time—but in recent years we’ve begun to see a new paradigm that marketers have been slow to recognize.

It’s not simply the creep of Black Friday into Thanksgiving day, or the expansion of BF into BFCM and then Cyber Week. In recent years, the nation’s biggest retailers began referring not just to T-5 (the so-called Turkey Five: Thanksgiving, Black Friday, Saturday, Sunday, and Cyber Monday) but to T-11. By the time Black Friday rolls around, discounts have been available for days—if not weeks.

Shoppers are beginning to catch on, too. Last year, a viral TikTok video—shot by a customer at a big-box retailer—gave away the ruse. The shopper digs behind the Black Friday price card on a television display, and pulls out the old sale card behind it—for the exact same price. It’s a meme that illuminated a broader collective vibe shift: Culturally, the rush of Black Friday seems to be fading. Is it cooked?

History may show that 2023 was the year the dam broke in terms of moving sales back by not just hours or days but weeks: Holiday shopping last year started, essentially, in early November—and even earlier if you factor in Amazon’s October Prime Big Deal Days, which in 2024 were held October 8-9.

On Gupta Media's Social Media CPM Tracker, we’re seeing Meta’s advertising rates — which tend to track with consumer demand — stay relatively flat year-over-year in November and December, as compared with steeper increases in September and October. That’s consistent with the idea that online marketers have squeezed nearly as much juice as possible out of their campaigns in the run-up to the holiday season — and are now beginning to expand their prospecting earlier into the fall.

In 2023, we began mashing up multiple data sets to look for holiday advertising value that other agencies were missing.

We begin with our CPM data, which gives us day-by-day granularity on how social media rates vary, day to day, during the crucial Q4 holiday shopping season. Then we layer in equally-granular data on consumer intent — measured in the amount of money spent by consumers during those same days. What we’re looking for are the places where CPM is relatively low and consumer intent is relatively high. Last year, and again this year, we found value to be mined in a specific platform —TikTok— during a one-week span adjacent to the most coveted shopping weekend of the year.

We also found that CPM rates for TikTok and Meta stay relatively higher during a key holiday-shopping period when consumer intent is relatively lower — suggesting that advertisers may be overpaying during a time when demand is mis-aligned.

First, the good news. Our data shows that advertisers looking to jump-start their BFCM campaigns may want to look at TikTok ads during the week before Thanksgiving. In 2023, the key period occurred November 14-20. In 2024, because Thanksgiving falls later, we believe the week to focus on will be November 19-25. Are we trying to make Jump Start happen? Yes, yes we are. Feel free to suggest a better name, but that’s what we’re going with.

During the Jump Start period in 2023, CPM rates were sagging — for the week of November 14-20, TikTok’s ad rates were 13% cheaper than the monthly average. And during the same week, overall consumer purchases were escalating from $3.1 billion per day on November 14 to 3.97 billion per day on November 20. The combination of lower CPM and elevated consumer intent during Jump Start week suggests untapped value for advertisers.

By contrast, consumer intent begins to drop right around December 12 — about the time that online shoppers go into last-minute mode. Between December 13 and December 24, overall consumer spending plunges from $4.36 billion to $1.36 billion. During the same span, TikTok CPM rates hover between $4.50 and $5 — above average for the month.

While some advertisers may need to keep the wheels turning for last-minute gifting, we believe the most efficient play for many advertisers in 2024 will be to shift spending from mid-December to a Jump Start in mid-November.

With Thanksgiving falling late, platforms are projecting a condensed shopping season for 2024 — advertisers have five fewer days between Cyber Five and the end of the year to close the deal. With consumers typically spending billions per day during that stretch, retailers are under pressure to make sure they front-load those sales — which means every campaign decision is amplified. Here are 5 best-practices to making the most of your holiday rush, based on data from the top digital ad platforms:

1. Early Engagement is Critical: Across platforms, consumers are starting holiday shopping earlier. Google notes that "deliberate" shoppers begin wishlisting as early as May, with 34% of shoppers last year saying they began shopping by July. (That’s up 6% year over year.) According to Tinuity, nearly half — 48% of shoppers plan to finish at least half of their holiday shopping by Thanksgiving. TikTok confirms this shift: the platform sees a 190% increase in videos tagged #holidayshopping in the two week period straddling Halloween. Not coincidentally, retailers like Amazon and Target have begun scheduling prominent deal-based promotions in early- to mid-October.

2. Cyber Week as a Focal Point: Deal-seeking peaks during the Cyber Five (Thanksgiving to Cyber Monday), making this period a crucial opportunity for advertisers to capture consumer intent. Platforms like Facebook and TikTok, especially for Gen Z, are central to inspiration and purchases during this time.

3. Self-Gifting and Personal Spending Growth: A growing trend is self-gifting, with TikTok users leading the charge. Nearly 87% of TikTok users plan to buy gifts for themselves, and Gen Z's self-purchasing habits are more than double that of Gen X and Boomers.

4. Late Holiday Shopping Shifts to In-Store: If you’re looking for value during the waning days of the holiday season in mid-December, data shows that 41% of last-minute shoppers turn to in-store purchases rather than expedited shipping, which presents an opportunity for omnichannel advertisers.

5. Post-Holiday Engagement: Google’s holiday guidance highlights "devoted" shoppers who continue spending into late December and early January—the period sometimes referred to by Meta and TikTok as “Q5.” Advertisers can run campaigns beyond Christmas to capture these late-season buyers.